Some Of Accountants Journal

Wiki Article

The Ultimate Guide To Accountants And Auditors

Table of ContentsAccountants Firms Things To Know Before You Get ThisThe Ultimate Guide To Accountants JournalLittle Known Facts About Accountants Tax Preparers Near Me.The 5-Second Trick For AccountantsGet This Report on Accountants Tax Preparers Near MeAccountants Journal for Beginners

Whether you help a business or run your own accountancy company, your employers or customers need to be able to trust you with their economic details. If other people in your life know that you're sincere and also that they can trust you with delicate details, you could take into consideration ending up being an accounting professional.Being an accounting professional indicates having to describe financial resources and economic details to clients or colleagues who aren't familiar with bookkeeping terms. accountants near me. If you're efficient describing tough or challenging principles in basic, easy-to-understand terms, this is an exceptional quality to have as an accounting professional. Having the ability to function well with others can help you thrive in accounting.

9 Easy Facts About Accountants Services Explained

Accounting professionals require to have a sense of responsibility when these type of problems come up, such as throughout an audit. Being an accounting professional entails making judgment calls every now and then. If you want to approve responsibility when points fail as well as take actions to fix your errors, you have yet another quality that makes an excellent accounting professional.Remaining in accounting means encountering troubles as well as challenges once in a while. You'll need to be ready to see these difficulties through in order to do well in this area. Being effective as an accountant entails locating ways to stay effective or improve efficiency, as required. When you're effective, you could additionally have the ability to aid your company boost its effectiveness generally.

If you can do standard math issues, consisting of including as well as deducting, you'll have a simple time doing these estimations as an accountant. Remember that you'll have tech tools to assist you handle extra complicated mathematics calculations, and also you won't need to have a comprehensive understanding of trigonometry, algebra, or various other sophisticated mathematical principles to master audit.

Accountants Tax Preparers Near Me Fundamentals Explained

You'll need time administration skills to make certain you have the ability to finish your service time without feeling bewildered. If you are interested in finding out more about the bookkeeping level offered at Wilmington College Cincinnati, demand details today! (accountants book).Staff accountants work in a business's division. more info here They commonly report to a Senior Accountant, Accounting Supervisor, Controller, or Chief Financial Officer. Personnel accountants are required. A personnel accountant placement is typically taken into consideration a slightly above staff member. While an accountant setting is often much more seasoned than your common team accountants.

As well as if the accountant is very humble and favors discreetness versus being braggadocious, an accountant can be someone in monitoring. This kind of expert likes to be called what they go to their core. Accountants frequently are assigned jobs on maintaining monitoring expenses and also budgets. Whereas team accountants have generally fewer credentials and are provided less obligations.

The Definitive Guide to Accountants Firms

The designation of "" means Cpa. A setting for a personnel accounting professional does not generally need a Certified public accountant credential (these positions really never do), it will be the hope usually that a staff accountant intends to examine as well as take the. Coming to be a CPA candidate will be fascinating information to a lot of companies.

Examine This Report about Accountants Book

They should be able to be certain in their capacity to take advantage of computers abilities to find out as well as make use of fundamental bookkeeping software application such as or. The general kinds of bookkeeping are,,, and also.

The greatest placement differs with the organization. In a public accounting company, being named is the highest degree. That claimed there might be a number of Companions, with one individual usually marked why not try these out as the. In huge publicly traded companies, the (CFO), is the accounting as well as finance leading dog. In other firms, the title of suggests the highest-ranked accounting professional on personnel.

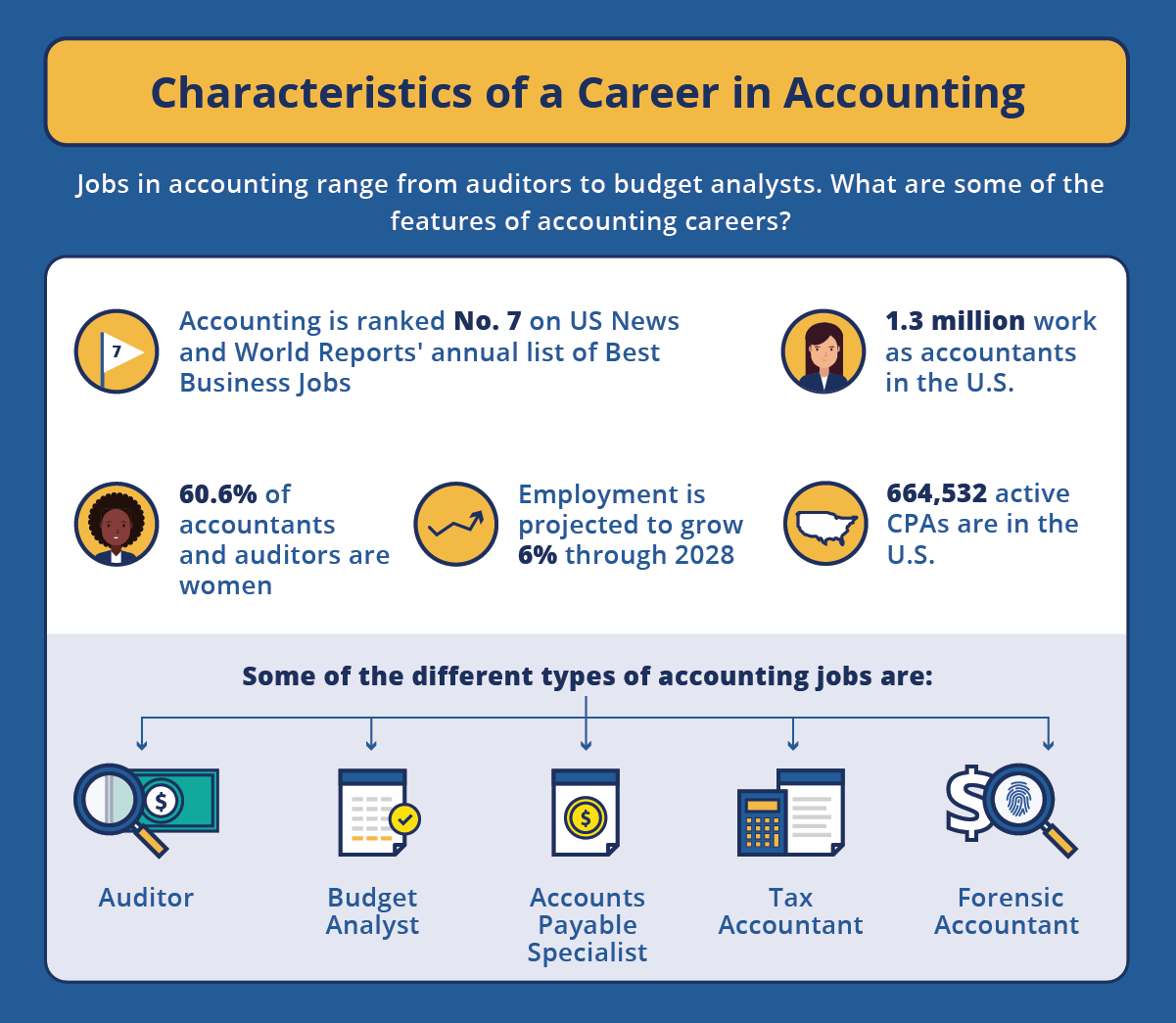

The kinds of accountants (relying on that you ask) in some circles are referred to as Expense Accountants, Managerial Accountants, and also Financial Accountants. A CPA as well as an accounting professional are not equally exclusive. They are terms that can be associated with each various other. An accounting professional who has actually passed the criterion to achieve the status of CPA or Certified Public Accountant is considered even more knowledgeable and also experienced and also can command a higher salary.

The Basic Principles Of Accountants Tax Preparers Near Me

These positions and the working with supervisors included may choose candidates/employees that have their. That's if they had their druthers. If you desire a higher-paying position with more duty, a CPA credential is worth going after. Yes definitely, however you will more than likely gain a higher salary as a CPA.All that stated, there's a substantial number of accountants that do not have a CPA. For several, pursuing a Certified public accountant license is not worth the needed time financial investment to accomplish licensure.

Report this wiki page